This post contains key demographic takeaways from our 2021 Omnichannel Consumer Trends study.

Shopping patterns in the US have changed dramatically since January 2020, when the first coronavirus case was reported in the US.

Consumer spending plunged amidst lay-offs and shelter-in-place orders. Over 100 retail chains pulled down their shutters temporarily in March and April 2020 and unemployment skyrocketed.

Both consumers and businesses innovated to keep up with the limitations. Online shopping and hybrid models (like curbside pickup) made giant leaps.

As US retail recovers from the shock of the last of the two years, we explore what this means for retail and look into the question: which of the pandemic trends will stick?

We surveyed 1,200 shoppers across the US to learn more about their shopping habits and preferences. What we found is some startling differences in how men and women and different age groups shop.

Key demographic takeaways for retail

1. Men are more concerned about COVID-19 than women when shopping in-store

Though both women and men were shopping online more during the pandemic, the reasons keeping them out of stores were strikingly different.

While men were more worried about COVID-related health concerns (71%), women were put off by product unavailability (57%) and long lines at checkout counters (51%).

Young women, in particular, expressed less concern about COVID-19 while shopping in-store.

2. A preference for convenience over bargain

Conventional thinking is that price is the biggest factor driving the decision of where to shop: people will shop where they get the best deal.

However, our survey of 1,200 US shoppers shows something different. Shoppers opt to shop online not because it offers a better bargain, but because of the ease of placing an order and the convenience of home delivery. In fact, 70% of online shoppers said they did so due to convenience and only 36% due to cheaper prices.

3. All ages see a need for curbside and in-store pickup

2020 saw an explosion in curbside and in-person pick-up as consumers sought new ways to shop. And it’s not just Gen-X and millennials who are driving omnichannel retail. Older shoppers are opting for in-person and curbside pickup to get products faster as well.

4. Millennials shop via apps/websites

Surprisingly, we found that the age group driving online retail was millennials and not Gen Z. While the youngest (18-24 years) and oldest (54+ years) age groups preferred in-store shopping, 25- to 44-year-olds drove online shopping.

Disaggregating the data further, 35- to 44-year-olds preferred shopping via websites (45%), while 25- to 33-year-olds were most likely to use apps (23%) compared to other age groups.

When those who prefer online shopping were asked why they did so, millennials were far more likely than any other age group to report valuing the convenience of placing an order online (76%), the large selection of online products (65%), and cheaper prices (45%).

Other shopping trends found from the study

5. Data privacy and security hamper the online retail experience

Though consumers of all ages are spending more time online as well as shopping more on social media sites, they expressed concerns about sharing data to make this customization possible.

This is especially so among men, who reported greater data privacy (45%) and security concerns (42%) than women.

While on the one hand, people’s entire lives moved online in 2020, from schooling to grocery shopping to telehealth consultations, on the other, there has been increased media coverage on the antitrust violations of Big Tech.

Consumers are now increasingly aware of how their online lives are being tracked by giants like Google and Facebook and sold to advertisers to create personalized ads. This has led to increased data privacy and security concerns among shoppers.

Other issues that can make online shopping a frustrating experience include unclear return policies (34%), digital payment failures (32%), and difficulty finding the product on the website or app (27%).

6. In-store is still the most convenient option for daily groceries

Household essentials (83%) continue to dominate in-store shopping, as consumers like handpicking items and the convenience of “grab-and-go.”

Fashion and clothing is another segment where customers prefer to try on products first before buying them. Women, in particular, prefer shopping for fashion in-store (73%) either for functional reasons (sizing differences) or recreationally (as self-care).

7. Men prefer to buy household essentials and home furnishings online compared to women

When it comes to shopping for household essentials, men prefer to buy household essentials (67%) and home furnishings (46%) online compared to women, both of which categories women prefer to buy in-store.

Another category that stood out in the gender-wise break-up of online shopping was that men were significantly more likely to shop for electronics online (64%) compared to women.

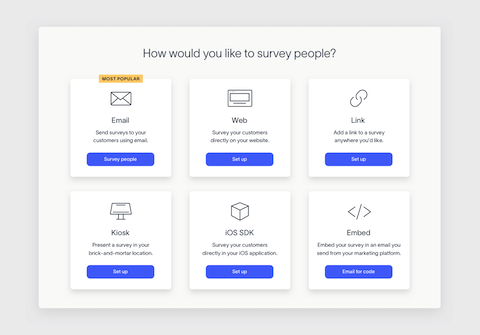

About Delighted

Our customer experience solution makes it possible to derive actionable insights from real-time feedback collected from consumers via email, a link, in-app, through your website, or an in-person kiosk. For customers who are constantly swapping devices and searching for memorable experiences, Delighted is a great way to reach them wherever they are.