When it comes to sending Net Promoter Score (NPS) surveys, timing is everything. Selecting the precise time to solicit feedback from your customers can have a huge impact on both the quality and quantity of the responses you receive. If you send your NPS survey too early, your customers may not have a full story to tell. If you survey too late, you could lose the raw emotion felt during the experience, as well as those critical details that tend to fade away over time.

The key to running a successful NPS program is your ability to maximize the number of people who provide feedback, as well as the completeness of that feedback. Survey timing influences both of these. Although survey timing may vary based on your brand’s products or the type of feedback you want to collect, understanding when to survey your audience can be incredibly beneficial.

The old way of timing customer feedback surveys

Many companies conduct their feedback programs on an annual or quarterly basis. They typically involve long and complex surveys sent to nearly all of their customers, past or current, in one large blast. Administering feedback programs in this manner is time consuming and complex.

Sending surveys in this sort of cadence is ineffective for a few reasons:

- Customers are asked for feedback at seemingly random times and are typically less engaged with the business

- If surveys are sent too long after a purchase/interaction, customers will more than likely forget the critical details of their experiences

- Today’s consumers are more security conscious, which means that they are less inclined to open and respond to emails that are seemingly random — especially if the survey doesn’t match the look of your brand

Finally, companies who send these long surveys only a few times a year are typically requesting too much information from customers at the wrong time, which is a sure-fire recipe for low response rates.

A better way to survey your customers

A better way to survey your customers begins with a bit of planning to uncover what type of feedback would help your business the most, so you can send a short, easy-to-answer survey at just the right moment. Here’s how you can get started:

Ask yourself, is the feedback you’re looking to collect transactional or relational? Depending on how you phrase your NPS question and your survey timing, you can gather either type of feedback.

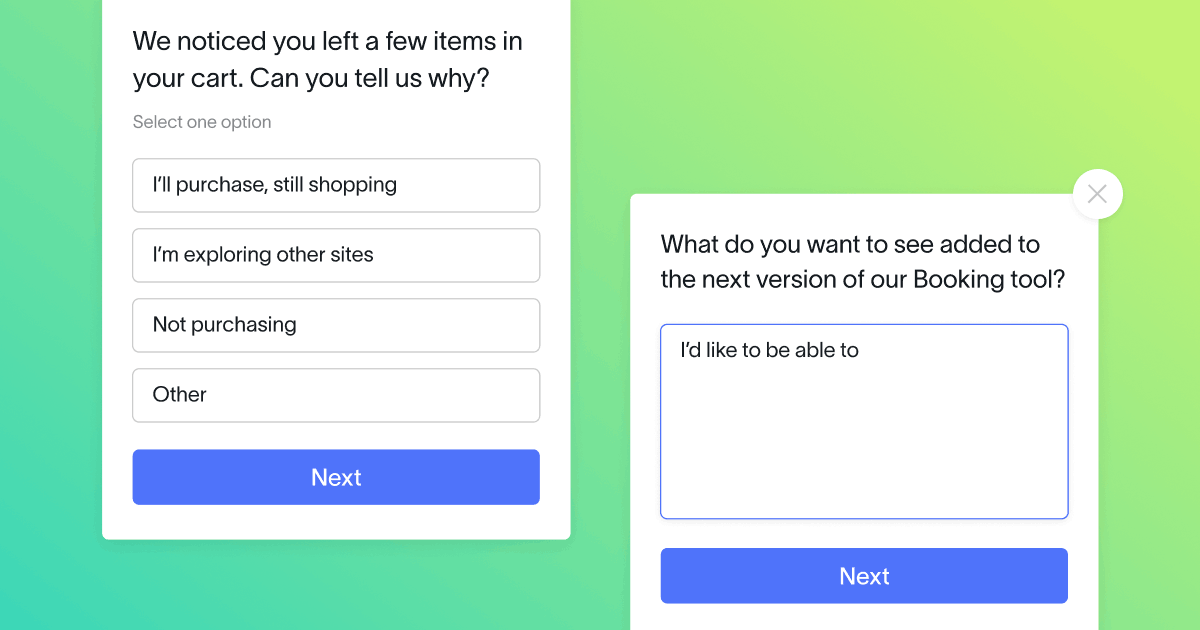

Transactional feedback is prompted just a short time after a customer engages with a company, typically following a purchase or support request to measure the quality of that specific interaction.

The transactional NPS (tNPS) question would be: How likely are you to recommend us based on [your most recent interaction]?

For example, an ecommerce clothing company that wants to evaluate their customer support team would send out a survey immediately after a support ticket has been resolved. If they want to understand how a customer feels about their product, they would send a survey after an online order is marked received so the customer has time to try out their purchase.

Note that tNPS isn’t always the best way to gather transactional feedback. You can also use Customer Satisfaction Score (CSAT) or Customer Effort Score (CES) surveys. For more information, read the full guide on relationship versus transactional surveys.

Relational feedback, on the other hand, is solicited multiple times during the customer lifecycle and is intended to measure the strength of a customer’s relationship with a company over time.

The standard NPS survey question is relational: How likely are you to recommend us to a friend?

Relational feedback takes place on a scheduled cadence. Most companies request relational feedback on a quarterly, biannual, or annual basis. The best way to start defining your relational survey cadence would be answering these questions:

- How often do customers have a new, meaningful interaction with our company?

- Is this occurring weekly? Only once per year?

Here are some general guidelines for establishing how often to send an NPS survey based on your business:

- Quarterly NPS surveys are best suited for companies that have established customer bases and stable customer relationships, like a subscription service.

- Annual cadences are often well-suited for companies with periodic transaction frequency, such as banks, insurance companies, household services, and high-end retailers.

- More frequent feedback cadences can be implemented by companies that have less predictable customer interactions or operate in incredibly competitive and dynamic verticals. Companies in this group might be cable enterprises, big-box retailers, mass transit, and convenience stores.

With our experience management software, you have the flexibility to survey customers at the most optimal moment in their journey. That moment varies by business type, but leading companies request transactional feedback after milestone transactions (i.e. onboarding, purchase, support), while monitoring overall loyalty with quarterly or biannual relationship feedback.

In light of this, we’ve put together a few guidelines on how to identify the right moment to survey your customers.

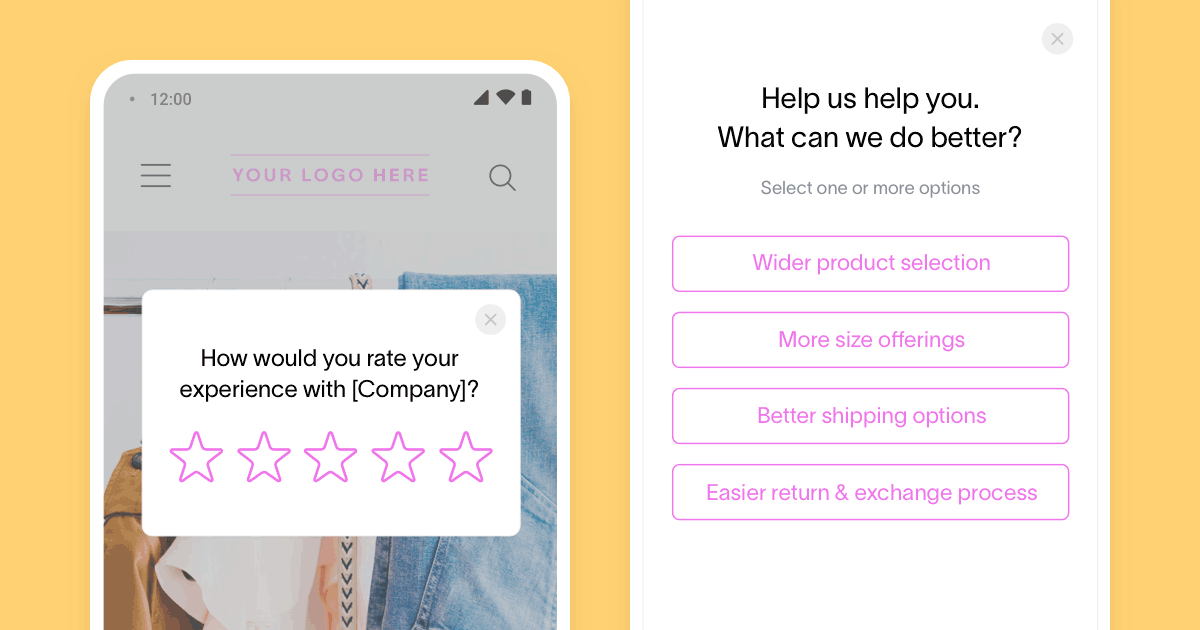

NPS survey timing for retail and ecommerce brands

When a physical good is involved, survey timing is relatively straightforward. You can typically pinpoint the optimal survey point by starting with the delivery date and adding just enough time for the customer to fully experience the product.

In the case of consumables, like food, that point would be soon after delivery. Some products, like mattresses, require longer evaluation windows so sending a survey a few weeks from the delivery date will ensure that optimal product feedback is collected.

Men’s clothier Bonobos surveys customers a few days after their new clothes arrive, giving customers time to try them on while allowing a little extra time for customers who don’t open the package the day it is delivered. Another approach is to stagger surveying, asking some customers for feedback shortly after the product has been delivered, and others a few weeks later. This can give you a more comprehensive view of your customer’s experiences.

Surveying doesn’t have to be limited to first-time buyers. However, the tempo of surveying should track with the relative uniqueness of each order. The more unique each order is from the last, the more often you should ask for feedback — within reason.

If each order is totally unique, surveying folks every couple of months is reasonable. If your product does not change, you probably don’t want to survey your customers more than once a quarter to 6 months, just frequent enough to make sure you’re maintaining the experience you’ve been delivering.

NPS survey timing for B2B and SaaS brands

The buying process for business customers can take much longer than it does for consumer customers. This can make deciding on the right moment to ask for feedback a bit tricky. To overcome this, it’s often helpful to break the customer journey into two phases: the “early” phase and the “on-going” phase.

In the early phase, request feedback once a customer has successfully on-boarded and begun using your product. Many SaaS companies will ask for feedback a few weeks to a month after a customer subscribes to a paid plan, while service-oriented companies will typically survey shortly after completing a job or project for a client.

For on-going relationships, you can ask for feedback on a quarterly, semi-annual, or annual basis. The time period you choose should be aligned with the stability of your delivered experience. If your service rarely changes, you’ll want to pick a longer time period — a short time period could result in duplicative feedback. If you are a young software startup with a product and support team that is changing rapidly, quarterly surveying may be more appropriate.

NPS survey timing for on-demand products

For companies that deliver an experience or product at the push of a button, survey timing is critical — but the same general principles still apply. For example, rental car company Silvercar surveys customers shortly after they return the vehicle. At this point, they’ve experienced the entire service lifecycle including booking, pickup, driving, and returning.

Additionally, HotelTonight, which helps people find last-minute rooms at luxury hotels on-demand, sends their surveys the day after a guest checks out of a hotel. HotelTonight cares about both the booking experience in their app, as well as the complete guest experience at the hotel. Neither of these companies will survey customers again for a few months. This blackout period ensures that they’ll be able to collect feedback from these customers in the future.

NPS survey timing for consumer products

Companies that produce physical products should start with a similar approach to retail and ecommerce and give customers enough time to experience the product they’ve purchased.

One recent trend is the increasing use of companion web services and mobile apps in conjunction with physical products. Customers will often have to register or activate the product on the manufacturer’s website or mobile app. This can enable a much better understanding of product usage patterns, as well as provide a direct method of communicating with the customer who may have purchased the product from a 3rd party retailer.

As with retail and ecommerce, the optimal point to solicit feedback will vary with the type of product. While some products allow for snap judgment, others will require the customer to more deeply integrate the product into their lifestyle before they can form an opinion — like a new smart thermostat or home audio system.

In those cases, if you were to survey the customer when the product was registered or activated, you’d miss the key insights that can only be uncovered after weeks of use. Even worse, customers who are surveyed before they’ve fully evaluated a product are likely to give you a low NPS score, even if they go on to eventually become a loyal promoter. People typically won’t feel comfortable recommending something they have not yet fully vetted.

So, what is the best time to send an NPS survey for actionable feedback?

The best time to send an NPS survey is after a meaningful interaction with your brand. That way, customers will have experienced enough of what your business has to offer to know whether they would recommend you to a friend.

Maximize survey timing with automated sends from Delighted

Choosing the right moment to survey can have a profound effect on the quality and quantity of the feedback you receive. While the specifics around when to survey vary with different business and product types, establishing the type of feedback you want to collect is always the best place to start your survey planning. After that, your team should evaluate which CX tools are automated yet flexible enough to support your brand’s survey cadence to collect the insight your business needs.

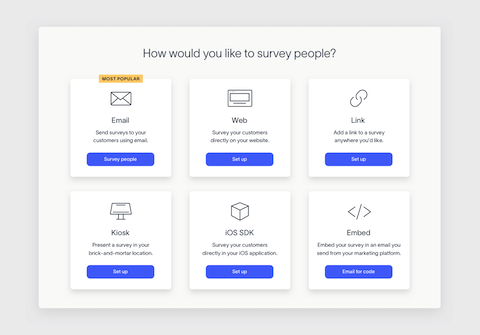

Delighted is the fastest and easiest way to gather transactional and relational feedback from your customers. Optimized for high completion rates, Delighted can automatically send surveys (NPS, CSAT, CES, and more) at a time of your choosing via your preferred delivery method (Email, Web, Link).

Take Delighted for a test drive for free and start collecting actionable insights using our experience management software.