You’ve done the hard work and earned your customer’s attention, but do you know how loyal they are to your brand or how engaged they are in your business? Do you know why some customers tend to stay while others go?

Relationship and transactional surveys measure your customer experience, whether that’s through Net Promoter Score (NPS), Customer Effort Score (CES), or Customer Satisfaction (CSAT) metrics, so that you can better understand the “why” behind customer engagement and loyalty.

These metrics help you work out where you can improve your customer experience to boost engagement and increase sales from potential and existing customers.

But what is the difference between relationship and transactional surveys? How do you decide which type of survey is right for your business and customers?

Let’s take a closer look at relationship versus transactional surveys using NPS, CSAT, and CES surveys as clarifying examples.

What are customer relationship surveys?

Relationship surveys show you at a high level where your customer experience needs improving and where you are doing well in your business. They ask customers to rate you based on their overall experience rather than on a specific product or service.

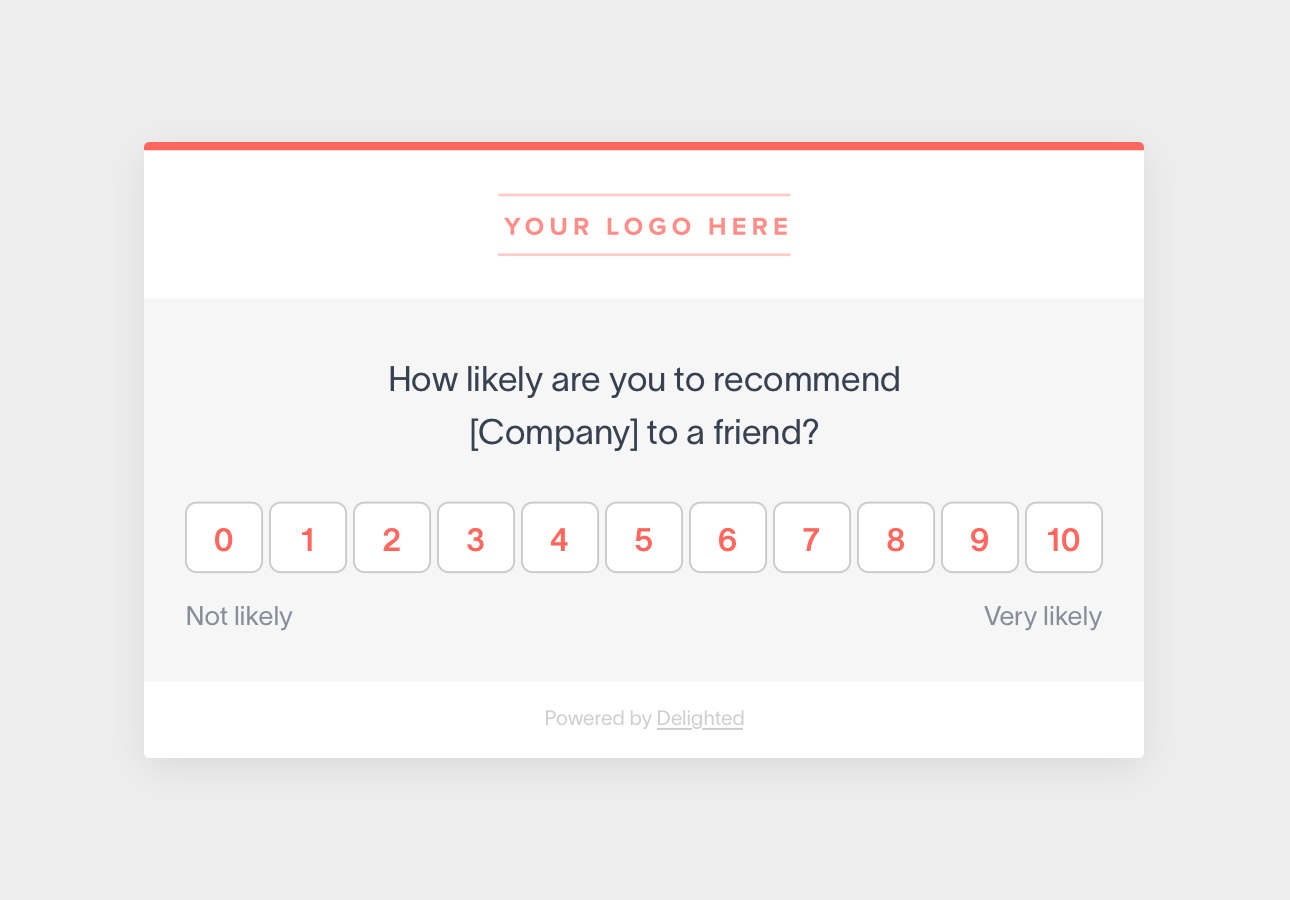

The most popular and well-known relationship survey is the NPS survey.

Relationship NPS surveys

The NPS system, created by Fred Reichheld from Bain & Company in 2003, uses a simple, standard question to measure customer loyalty and advocacy: How likely are you to recommend [company] to a friend? That Net Promoter question is followed by an open-form comment box so customers can elaborate on their answer.

NPS surveys provide the high-level perspective that defines the standard relationship survey. Sent on a regular schedule, NPS surveys generate a metric you can monitor over time to ensure your company is delivering a continually improving customer experience. Beyond the metric, relationship surveys also drum up helpful open-ended feedback from customers — offering clarity into what initiatives correlate to strong brand loyalty, and where that loyalty is faltering.

NPS is relevant for any industry. In fact, in the highly competitive tech industry, the Temkin Group found that “NPS is strongly correlated to customers’ willingness to spend more with tech vendors, try their new products and services, forgive them after a bad experience, and act as a reference for them with prospective clients.”

In a nutshell, relationship surveys help you understand customer loyalty to your brand. In addition to the standard NPS question, there are also other relationship survey questions that can help you understand retention, advocacy, and purchasing loyalty.

Here are some examples of relationship questions you can append to the NPS survey for expanded feedback and more granular insight:

- Retention: How likely are you to switch to another [company, provider, servicer, product]?

- Retention: How likely are you to renew your [contract]?

- Purchasing loyalty: Based on your experience, how likely are you to [purchase another product, use additional services] from [company]?

You’ll likely notice that these relationship survey questions are a bit more broad, and less specific to any particular interaction or transaction. This is by design. Relationship surveys are focused on surfacing feedback related to the overall customer experience. When coupled with the free-form follow-up question, relationship surveys can provide wide-ranging, holistic feedback about their experience — product, service efficiency, or otherwise. With just two quick questions, you’ll have multiple levels of insight into your customers.

Now that we’ve gone over what a relationship survey is, let’s break down the mechanics of setting up your relationship survey program.

Who should receive your relationship survey

The first step to sending a relationship survey is selecting which customers to ask for feedback. You can survey all customers for a broad approach, or choose specific customer or client groups for a more focused sampling. Who you survey ultimately boils down to the goals of your survey program and the feedback you’re trying to surface.

For example, try sending surveys to your lowest-sales or non-repeat customers. Since sales for repeat customers suggest you are likely doing something right with your customer experience, non-returning customers will provide a different perspective and help you figure out where you need improvement, or what you could do to motivate those customers to work with you again.

Best time to send your relationship survey

The second step is to decide when and how often to send your survey. Since relationship surveys are based on a complete experience of your brand, they should be sent after the customer has been able to experience your product.

To track your relationship survey score over time, survey your customers on a regular basis. Try 30, 60, or 90 day intervals, and see which is the best fit for your business and customers.

Ways to deliver relationship surveys

The third step is to determine what channel you want to use to send your relationship survey. Survey distribution can happen in person, over the phone, on a kiosk, or digitally. In more recent years, online survey distribution methods (email, link, and in-app surveys), have gained popularity due to convenience for both the company and the customer, as well as scalability.

Generally, it makes sense to choose a survey distribution channel based on how you generally interact with customers. If communication predominantly takes place via email, send an email survey. If meaningful interactions take place in-app, use a web survey.

For a more complete breakdown of how to send customer surveys, read about the pros and cons of each of the survey distribution methods.

NPS tools help automate the entire process, from survey creation and distribution to feedback analysis and CRM data integration.

Relationship surveys are great for understanding how loyal customers are to your brand, but as we’ve said earlier, the feedback does tend to be high-level, and will likely cover the entire customer journey. In order to get more targeted insights, we recommend tailoring surveys for the touchpoints that your relationship surveys have surfaced.

That’s where transactional surveys come in.

What are Transactional Surveys?

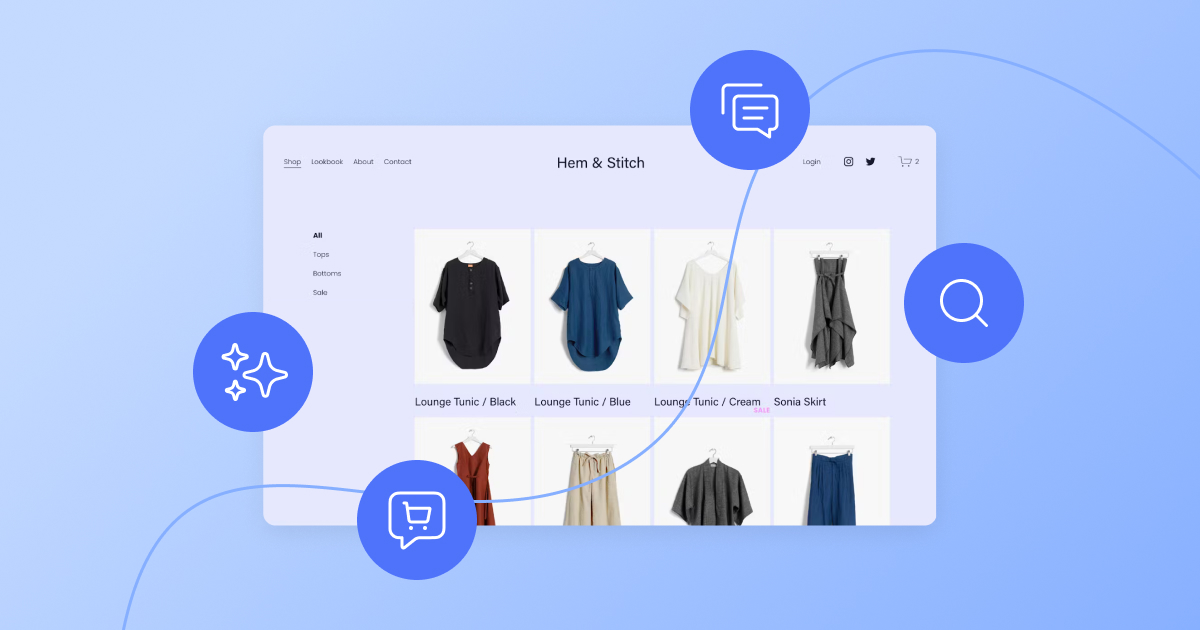

A transactional customer feedback survey is tied to a specific customer interaction with your brand. Transactional surveys get you down into the nitty-gritty by referencing a specific transaction or service used. You’ll gain immediate, actionable feedback on specific products or interaction touchpoints, such as the sales experience, customer support experience, or even your website experience.

CSAT and CES surveys are two different types of transactional surveys. You can also modify the phrasing and timing of an NPS survey to turn it into a transactional NPS (tNPS) survey.

Let’s go through each of these survey types for the transactional use case.

Transactional CSAT surveys

Customer satisfaction (CSAT) surveys are the classic transactional survey, and can be used at any customer touchpoint to evaluate whether the interaction has met the customer’s expectations.

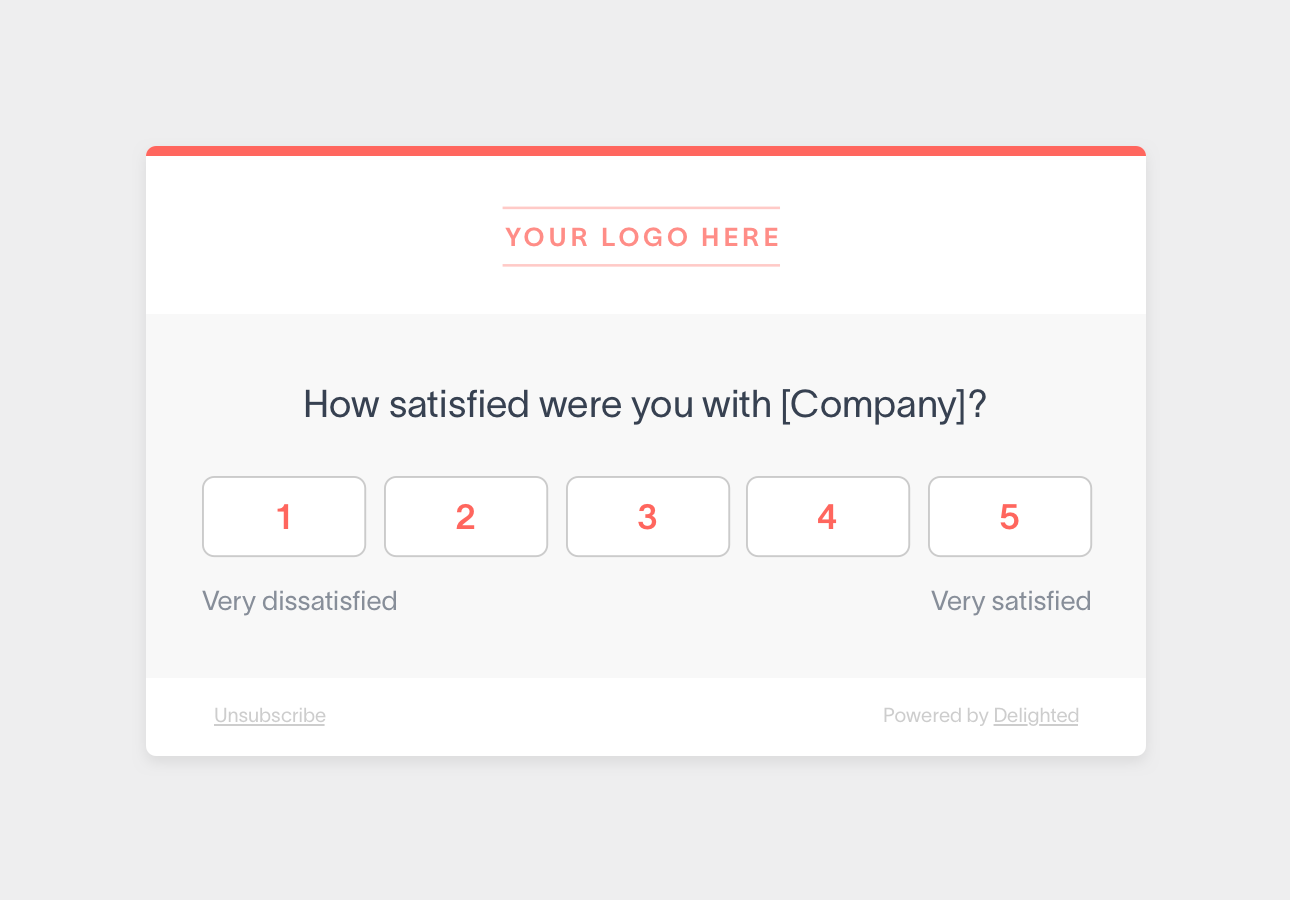

CSAT surveys ask “How satisfied were you with [company interaction/product]?” with a rating scale from 1 to 5. An open-form comment allows customers to explain the reason for their rating.

The stakes for customer satisfaction are high — studies have shown that 89% of customers switch to a competitor if they have a poor customer experience. Monitoring the satisfaction of key touchpoints and understanding how to improve them is paramount to future-proofing your business and driving growth.

Here are some examples of CSAT survey questions modified for different customer experience touchpoints:

- How satisfied were you with [the sales experience]?

- How satisfied were you with [the product]?

- How satisfied were you with [the onboarding experience]?

- How satisfied were you with [your customer service agent]?

Customer satisfaction surveys are an easy, straightforward way to gauge how you’re doing at any customer touchpoint. These transactional surveys should be sent to your customers immediately post-interaction or a few days after product delivery so that the feedback is fresh.

Transactional CES surveys

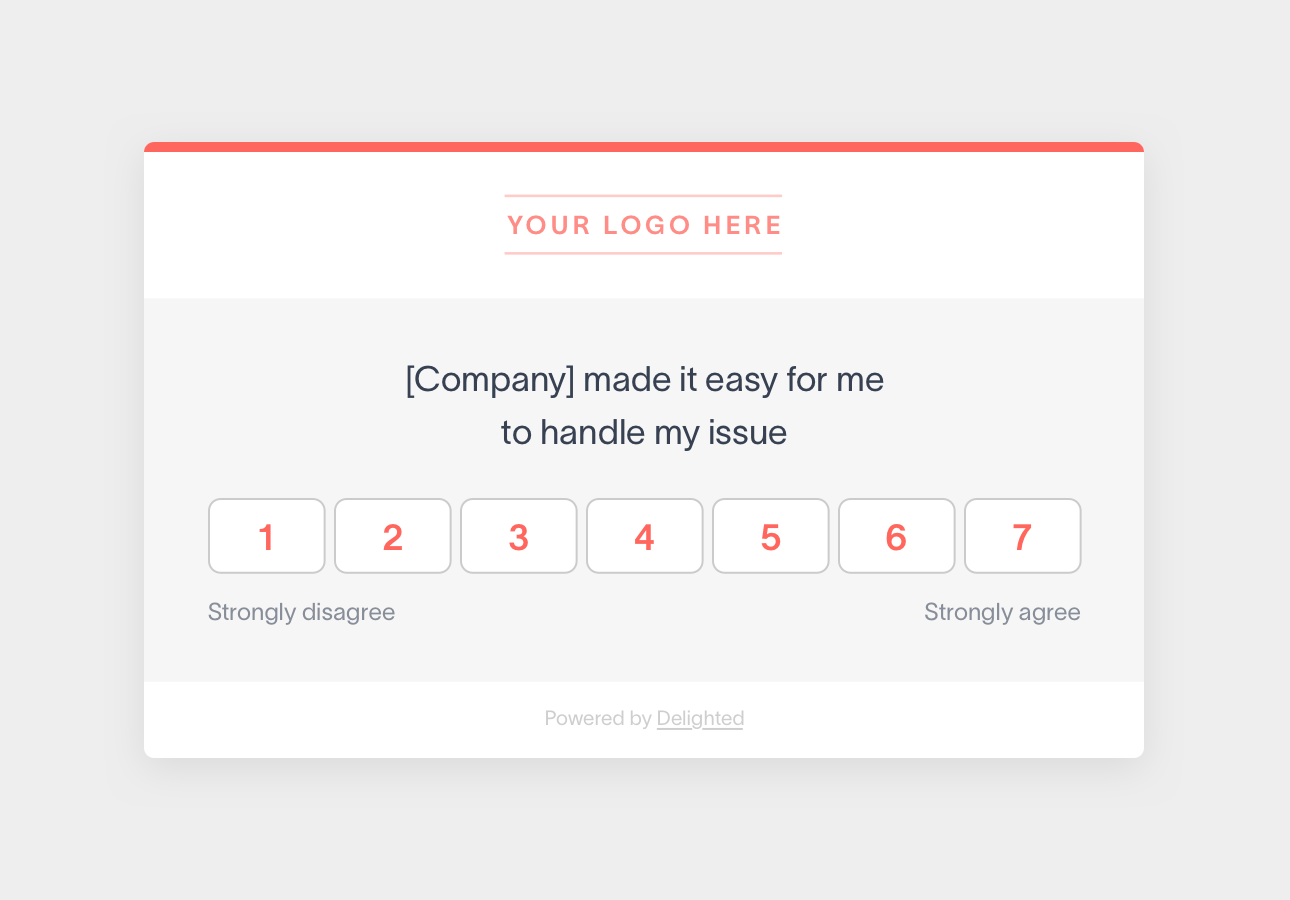

Developed in 2011, Customer Effort Score (CES) measures the ease of a customer’s experience with the statement: [Company] made it easy for me to handle my issue. Customers mark whether they “strongly disagree” or “strongly agree” on a scale from 1 to 5.

How much effort did it take for the customer to accomplish their goal? Studies have shown that reducing customer effort in the support process can also lead to increased loyalty, which is why CES is such an important metric.

You can modify the CES question in various ways to apply the survey to interactions beyond customer service. Here are some examples:

- For feedback on a support ticket: “[Service agent] made it easy for me to resolve my issue.”

- For feedback on the ease of an in-store or website experience: “It was easy for me to find what I was looking for.”

- For feedback on the ease of the online purchase process: “It was easy for me to make a transaction.”

- For feedback on a self-service feature: “[Tutorial/article] made it easy for me to resolve my issue.”

CES surveys should be delivered directly after a customer or client interaction to gauge the amount of effort it took to take an action.

What is a Transactional NPS vs Relationship NPS survey?

As mentioned earlier, the baseline NPS survey is a relationship survey that asks your customers to rate you based on their overall experience with your brand.

However, you can also modify the NPS survey question to make it specific to a service, product, or interaction. A transactional NPS (tNPS) survey question would be phrased: “Based on your most recent [experience/product purchase], how likely are you to recommend [company]?”

Whether you use CSAT, CES, or tNPS surveys as your preferred transactional survey type comes down to the customer experience you’re looking to gauge.

Interested in surfacing insights to drive down customer support resolution time? Consider CES for its direct alignment with customer effort. Trying to get a gauge on customer sentiment following a purchase experience? Leverage CSAT for a quick pulse on customer satisfaction.

Some companies find the “recommend” phrasing limiting for transactional use cases, and prefer to use CSAT surveys for those touchpoints. Since CES has its own angle, it is often the most effective format for measuring the ease of self-service and support interactions.

For simplicity’s sake, those who are already running a relationship NPS program may find it easier to get buy-in for tNPS, since their organization already understands the NPS metric. The “recommend” phrasing, when applied to a transaction, could also help those companies understand how much impact each customer touchpoint has on overall sentiment towards their brand.

No matter which transactional survey type you choose, survey distribution best practices are similar.

Who should receive your transactional survey

The specific experience you’re hoping to get feedback on determines who receives your survey. If you’d like feedback on a certain product, then only the customers who purchased that product should get a survey. Likewise, if you’re measuring the efficacy of your customer service team, only the customers who have reached out to customer service with an issue should be asked to provide feedback.

A more in-depth example would be if you wanted to evaluate your web content. For instance, say you want to measure the quality of a tutorial in your help center. You would only show the survey to people who have interacted with the page in a way that signals they are digesting the content (e.g. a certain time threshold, a particular interaction, scroll depth, etc.)

For transactional surveys, it’s all about the interaction you’d like to evaluate. Your audience must be qualified as people who have enough experience with that touchpoint to provide meaningful feedback.

Best time to send your transactional survey

Since transactional surveys are tied to a specific interaction, it’s imperative that your CSAT, CES, or tNPS survey is sent while the experience is still fresh on your customer’s mind.

Generally, the best practice for web, sales, or customer service interactions is to follow up immediately or by the next business day. For product feedback, following up within a few days of product delivery is customary, so that the customer gets a chance to use whatever they’ve purchased. Timelines vary by industry, so tailor follow-up to your specific use case.

Ways to deliver transactional surveys

For transactional surveys, the same distribution methods of email, link URL, website, kiosk, and in-person all still apply. Once again, you should choose the method that aligns most closely with where the interaction takes place.

For instance, a CSAT or CES survey for live chat support should be sent directly within the chat box via link. On the other hand, request email survey feedback for a sales demo.

For retailers who have both a brick-and-mortar and ecommerce store, having multiple survey distribution methods can be key to improving both the in-store and online shopping experience. Feedback on the purchase process could be collected via kiosk or a survey link that’s been printed on a receipt for the in-store experience, while web surveys could be used for the online experience.

Similar to NPS, having dedicated CES software or a customer satisfaction software can help you manage your customer experience program immensely. Survey creation and distribution follow best practices for increased response rates if you run them through a customer experience platform. What’s more, customer follow-up, results analysis, and feedback integration into your existing customer database, chat tools, and CRM can all be automated.

The differences between relationship and transactional surveys aren’t just in the survey question and delivery timeline — they also differ in the types of follow-up you can perform once you’ve calculated your scores and analyzed your results.

Calculating relationship and transactional survey scores

NPS, CSAT, CES, and tNPS score calculation depends on the survey rating scale.

However, NPS relationship surveys have one more benefit: the segmentation of your customers into promoters, passives, and detractors. This feedback-based segmentation is built into the score calculation, and can be an advantage when it comes to promoting your brand and figuring out ways to increase customer engagement.

If you use both relationship and transactional surveys, you can benchmark a transactional survey score against your overall NPS score to see if that touchpoint has a positive or negative influence on loyalty, or in some cases, no influence at all.

Score calculation for the NPS rating scale

NPS categorizes respondents based on their rating. For example, customers who choose 9-10 are promoters and your most loyal customers. They are happy with your service or product and likely to recommend it to friends and family, which can be a great business driver.

On the other hand, negative word-of-mouth hurts businesses. Customers who choose 6 and under are detractors and are generally unhappy with your service or product. Detractors are unlikely to recommend your brand to their friends and family. In some cases, they may even write poor reviews on 3rd-party sites to drive business away.

These metrics help you decide where to focus your customer engagement, such as understanding what makes the detractor crowd disappointed in your brand and how you can rectify it. It is also good to know what makes the promoters happy with your brand and how you can get your numbers up.

You’ll also want to be aware of the passive customers who gave you a rating of 7 or 8. These customers are less loyal and subject to favoring competitors over your company.

To calculate your NPS, subtract the percentage of detractors from the percentage of promoters, or use our interactive NPS calculator to calculate your score.

With your customers segmented in this way, you have a clear picture of who you can ask to be a referral reference, or who might be open to testing out a new product feature for you. On the other hand, you also know what group of customers you need to focus on to proactively prevent churn.

Score calculation for the CSAT and CES rating scale

Since both of these transactional surveys are on a 5-point scale, the method for calculating the score is the same. Simply take the number of those who gave you a 4 or a 5, and divide by the total number of survey responses you received.

Transactional feedback is, by design, hyper-focused on specific interactions and moments in the customer experience. However, don’t view this feedback in a vacuum. A customer could be satisfied with a certain interaction, but if they found any other part of the experience frustrating, they could still have a tendency to churn. Or, vice versa, a customer may have had one hiccup that was caught by your survey, but still be willing to advocate for you.

Using both relationship and transactional surveys to monitor customer happiness ensures all your bases are covered, and gives you a holistic understanding of the key drivers of customer loyalty.

Relationship vs transactional surveys for your customer experience program

The best customer experience programs incorporate both relationship and transactional surveys to their benefit. Combining the two gives you a bigger picture of your customer experience, whereas relying on data from just one or the other can leave gaps in insight coverage and team metrics.

If you’re only going to use one type, decide which metric is more important for understanding client engagement and aligns with your goals.

Relationship surveys give you a better overall idea of customer loyalty. Send them out to your entire customer base on a regular basis for feedback, and activate your promoters for brand advocacy while routing detractors to customer support for follow-up.

Transactional surveys determine the quality of a specific service or product and allow you to improve individual relationships immediately after customers have interacted with your company. If you only use transactional surveys, you miss out on the opportunity to define your loyal customer base versus those at risk of churn.

Each survey type offers unique insight into your customers and clients. If you’re brand new to running a customer experience program, consider starting with an overarching relationship NPS program, and then branching out into CSAT, CES, or tNPS surveys when you’ve identified which customer touchpoints need a bit more work. If your key performance indicators (KPIs) are tied directly to the efficacy of the website or the customer service team, consider starting with a CSAT or CES survey.

Whatever you decide, Delighted’s experience management software can help. With our Projects feature, you can manage multiple types of surveys (relationship or transactional) all from one account interface. Sign up for Delighted today to create and send surveys for free.

More recommended reading for setting up your customer experience program: