Well-crafted survey design allows you to gather actionable insights into your products, services, and organization. Designing surveys – ones your customers and employees will want to take – requires careful thought and planning. However, the results of your hard work will yield important sources of data that you can use to transform your business.

In this post, we’ll identify what good survey design entails, its importance, and steps to follow in order to get actionable feedback from respondents.

Jump to:

- What is survey design?

- Why is survey design important?

- 7 steps to achieve good survey design

- Survey design best practices

What is survey design?

Survey design is the process of creating an effective survey with the intent of gathering valuable insights from an audience. Designing a good survey includes deciding the survey’s goal, choosing appropriate questions, customizing its appearance, and testing the survey before sending it out.

Why is survey design important?

How you structure and design your survey matters.

Are the survey questions confusing? Are they too long? Developing surveys with best practices in mind can make or break whether a respondent will begin and complete your survey. And with a good survey design, you’re more likely to receive higher response rates, completion rates, and therefore, more accurate survey data.

Poor survey design, on the other hand, can lead to a lack of responses, misleading or vague results, and a missed opportunity to gather important information that could’ve been acted on.

7 steps to achieve good survey design

Understanding how to design a survey is necessary to capture (and keep) your respondents’ attention, analyze the data, and act on feedback insights.

Let’s walk through how to design a survey, write effective questions, and collect the highly impactful data you’re looking for.

1. Identify the purpose of the survey

The first step of good survey design is to determine the purpose of your survey. It’s important to define your overall objectives so you can gauge what you’ll get out of the survey, and plan for what you’ll do with the information.

Some common objectives for surveys are:

- Benchmarking customer experience metrics

- Getting feedback on your product

- Getting feedback on your employee experience

- Improving the sales or support experience

- Determining your employee retention rate

- Measuring customer satisfaction rate

- Testing branding decisions

- Scoping interest in new product areas

Once you’ve brainstormed the goal(s) you’d like to achieve, prioritize what you’ll be able to target within one, succinct survey. You can always address other goals in separate surveys as part of your ongoing conversation with your audience.

TIP: It’s helpful to inform your survey respondents about the survey’s purpose. To do this, send an email letting your audience know that you’ll be sending out a survey, what email it will come from, and what you plan to do with the feedback.

Whether the goal is to take a pulse on employee sentiment or to get feedback on your product’s new website experience – if they know why their responses are important and how they will be used, they are more likely to go the extra mile to complete your survey.

2. Choose the survey question types

When writing your survey questions, it can be challenging to decide which question types will get you the information you need. We’ve covered the common question types to use and avoid below, with examples of each.

Close-ended or open-ended questions?

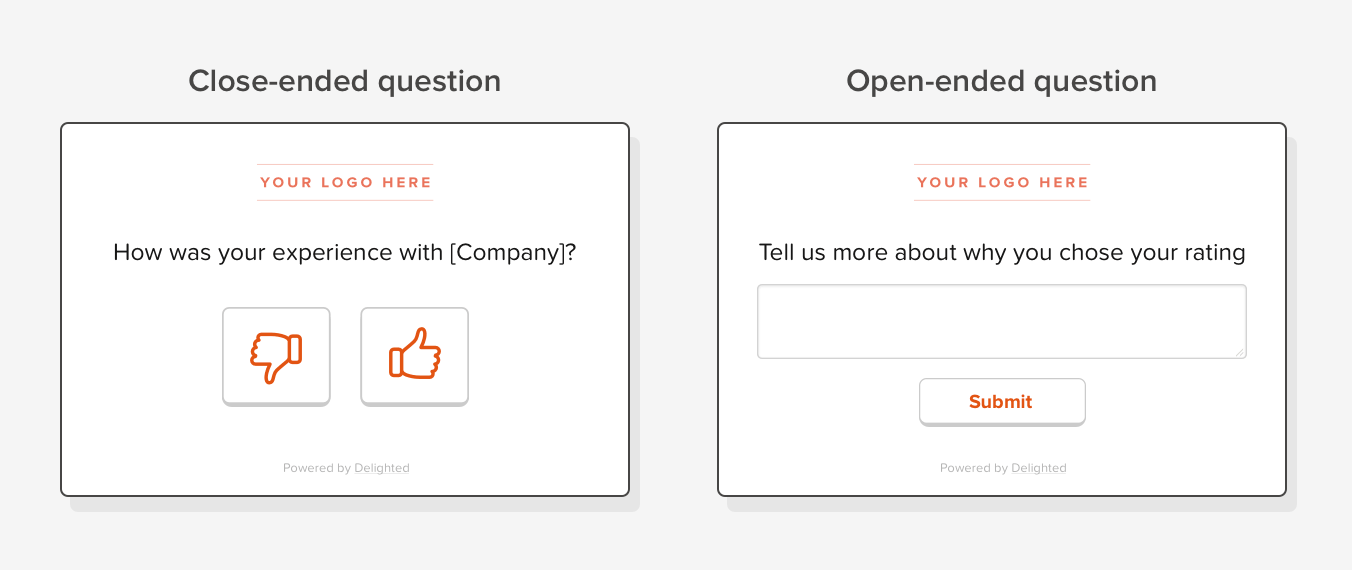

First, it’s important to understand that there are two ways to design your questions: they can be close-ended or open-ended. Your decision to create your questions as close-ended vs. open-ended (or both) depends on the type of data you want to collect and how you’re planning to analyze it.

Close-ended questions

Close-ended questions are questions that require respondents to choose from predetermined answers. These questions are commonly used to gather quantitative data that can be tallied into scores, percentages, or statistics and tracked over time.

Examples of these questions include yes/no, multiple choice, Likert scale, and rating scale.

Open-ended questions

Open-ended questions let respondents write their answers in their own words as opposed to choosing from a list of answers. These verbatim questions collect qualitative data that can be used in tandem with close-ended questions.

For example, a respondent can first select their thumbs up/thumbs down answer (close-ended question) and then explain their rating reasoning in a free response text box (open-ended question).

Good questions to use in survey design

Your survey should not only gather the exact insights you need but should be designed in a way that respects your respondents’ time. Using the quick-to-answer close-ended question types below will ensure you’re asking the questions in an efficient, yet impactful, way.

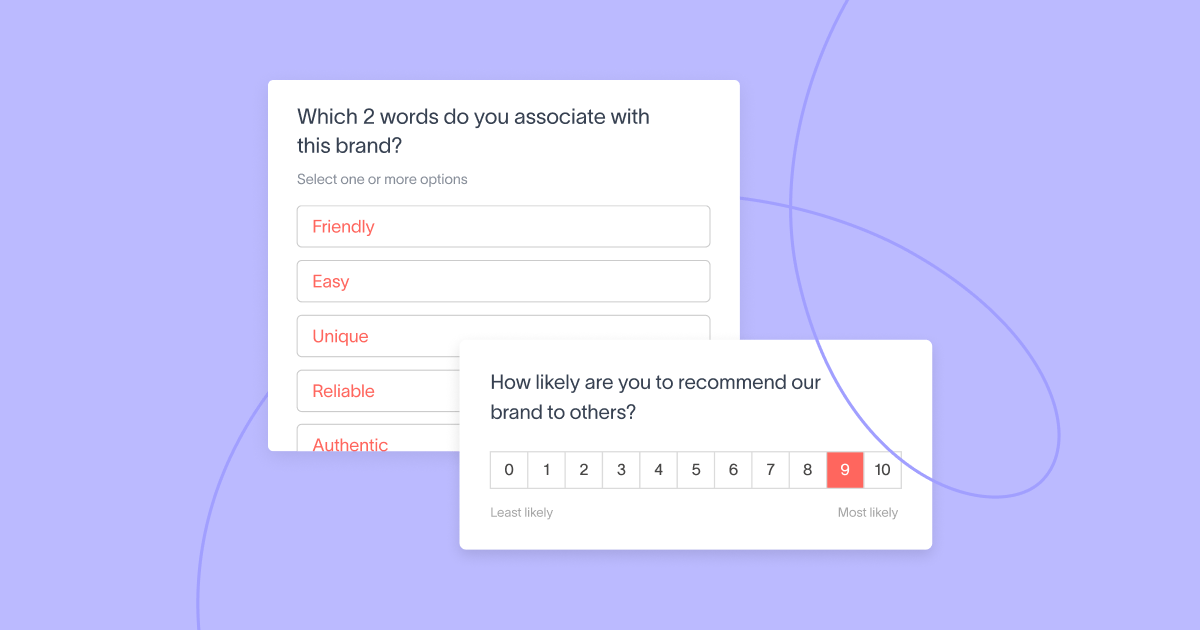

Multiple choice and multiple select questions

Multiple choice questions are questions that ask respondents to choose one (single select) or more (multiple select) answers from a list. It’s important to keep the answer options clear and concise for accurate response capturing.

One of the cons of multiple choice questions is that they can be limiting if the respondent doesn’t see a choice that fits their true answer. To mitigate that, you could offer an “Other” option with a free response text box so the respondent can write in their own answer.

Ex: Which type of coffee do you prefer?

A. Drip coffee

B. Espresso shots

C. Latte

D. Other

Likert scale questions

Likert scale questions ask respondents to choose from a scale of 5 – 7 answers, each option indicating a belief or sentiment. This type of question can also be called a rating scale survey question.

Ex: This [product/service] helps me accomplish my goals.

A. Strongly agree

B. Agree

C. Do not agree nor disagree

D. Disagree

E. Strongly disagree

Dichotomous questions

Dichotomous questions have only two answer options, including yes/no, true/false, thumbs up/thumbs down, and agree/disagree. This simple survey question is an easy way to screen respondents or segment them into groups based on their answer.

Ex: Did you find the answer you were looking for?

A. Yes

B. No

Demographic questions

Demographic questions ask respondents about their personal characteristics – including age, race, gender, and household income. These questions can be used for segmenting your audience by certain traits so you can better understand your buyer personas and their preferences towards your brand.

Ex: What is your age?

TIP: Demographic questions should be placed at the end of your survey to avoid distorting the ultimate goal of the survey for the respondent. Retain your respondent’s focus on the questions that matter most to your goal, first.

Types of questions to avoid

Now that we’ve covered a few types of questions to use in your survey, let’s review question types to steer clear of – particularly, biased questions.

Biased questions are questions that sway a respondent towards a particular answer or confuse the respondent into answering in a way that doesn’t align with their true opinion. We’ve included a list of various types of biased questions to look out for, below.

Double-barreled questions

Double-barreled questions ask two questions in one and typically include an “and” or an “or” to connect the two elements. This type of question not only confuses the respondent on how to answer, but can also skew your survey results with incorrect information.

Ex: How satisfied were you with your purchasing and shipping experience?

A. Very satisfied

B. Satisfied

C. Not satisfied nor dissatisfied

D. Dissatisfied

E. Very dissatisfied

Leading questions

Leading questions guide the respondents to choose a certain answer. The questions are often written in a way – either with adjectives, assumptions, or skewed answer options – that would sway the reader to answer a question that’s favorable to the surveyor.

Ex: How excellent was your experience with us today?

A. Very excellent

B. Somewhat excellent

C. Not excellent

Loaded questions

Loaded questions make an assumption about the respondent. In the example below, the question assumes the respondent drinks coffee. If the respondent does not drink coffee, then no matter which answer they select, the response will be inaccurate.

To avoid a loaded question, start by asking a screening question to make sure the respondent fits the criteria, such as “How often do you drink coffee?”

Ex: How often do you purchase coffee instead of making it at home?

A. Very often

B. Somewhat often

C. Rarely

D. Never

3. Write your survey questions: Do’s and don’ts reminders

How you phrase your questions, the questions you ask, and the order of the questions are just a few things that play into good survey design and will allow respondents to complete your survey quickly and accurately.

Now that we’ve gone through important question types to use and avoid, here’s a proofreading list of additional best practices to reference as you write your survey questions.

- Do keep your questions short and simple so that respondents can quickly complete your survey from start to finish without confusion or survey fatigue.

- Don’t use absolutes such as “always,” “every,” or “all” in your survey questions. These words can inadvertently force the respondent to agree or disagree with your question, when instead, they may have a more nuanced answer.

- Do allow respondents to skip or respond “Prefer not to answer” to sensitive questions such as disability status or other personal information. Also, be sure to clarify why you’re collecting this information.

- Don’t ask questions with jargon that respondents may not understand, including unfamiliar acronyms. Using terminology that your audience will recognize helps to avoid potentially false responses.

4. Order questions from broad to specific

Ordering your questions in the most logical and straightforward way can help increase your survey completion rate and make your survey easier to understand.

The general rule of thumb is to start with more broad survey questions at the beginning, to introduce the survey topic, and then make the questions more specific as the respondent moves through the survey.

No matter what, ensuring your survey has a logical flow should take precedence. After you’ve decided which questions to include and in what order, double-check that your question placement makes sense and that you’ve avoided switching topics frequently.

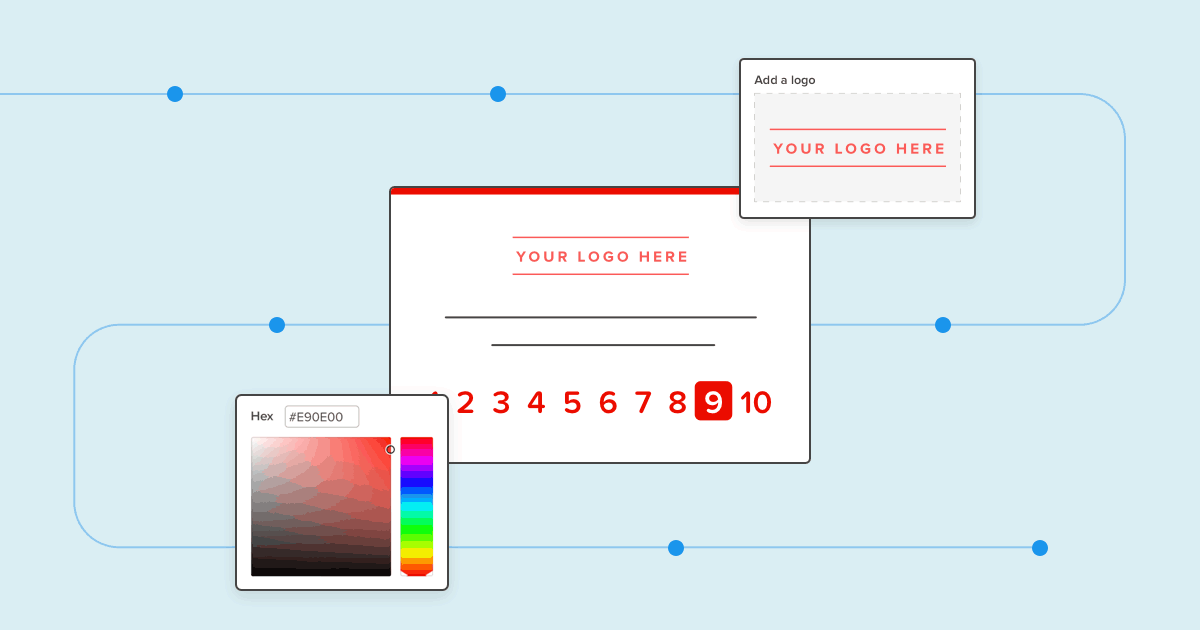

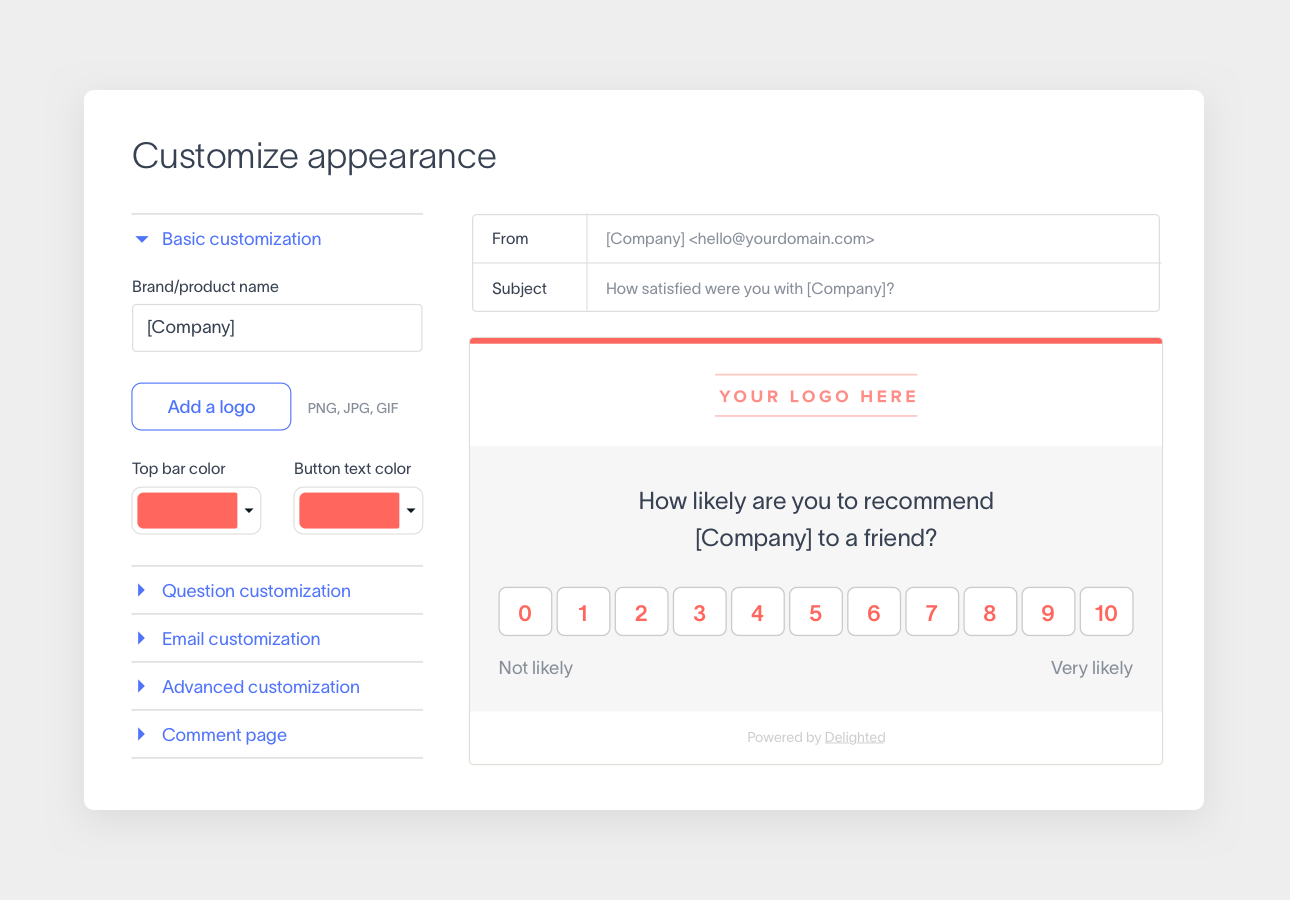

5. Design the survey appearance

Another important aspect of survey design is the appearance of your survey. Customizing the survey with your brand colors and logo will help create brand association for the respondent, so they know where the survey is coming from and who will be looking at their answers.

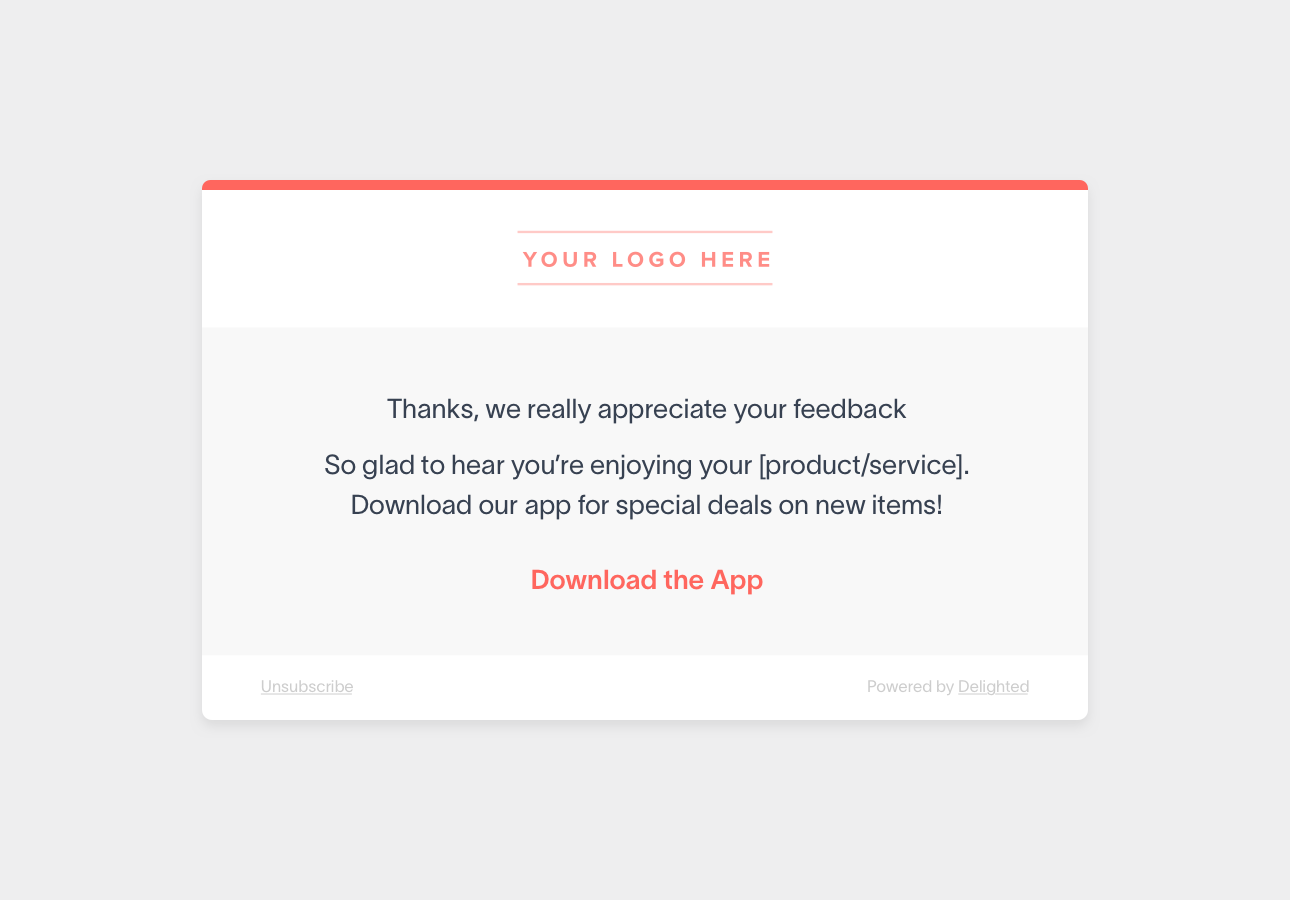

In addition, make sure to include a “Thank you” page at the conclusion of your survey. The final page of your survey should explicitly thank the customer for their time so they know their time is valued and appreciated.

Beyond the simple ”thank you,” you can also create a custom response depending on how the customer answered your survey. You can ask your positive scorers (promoters) to review you on a third-party site or act as a reference, or route your negative scorers (detractors) to a customer service team member to resolve their issue.

6. Preview and test your survey

Testing your survey with colleagues is an often overlooked but incredibly important step in successful survey design. Request feedback from counterparts, stakeholders, or higher-ups to answer the following questions:

- Are there any questions that could be confusing or unclear?

- How long did it take you to complete the survey?

- Did you encounter any problems while taking the survey?

- Are there any visual elements of the survey that could be improved?

Once you make the necessary changes to your survey, ask for a final round of feedback with the new updates to make sure your survey is in perfect shape before you send it out.

7. Analyze survey results for takeaways

To assess how well you designed your survey, analyze the survey results against the purpose of the survey.

For example, if you wanted to learn how customers feel about a new product design through a yes/no question, did you discover if the majority of your audience liked or disliked the updates? From the open-ended comments, what were the most common product improvement suggestions that you could take back to the team?

The effectiveness of your survey design will depend on whether the survey results fulfilled the survey’s purpose. If you did not receive the insights you were looking for, the analysis step is the perfect opportunity to go back to the drawing board (with these best practices for surveys in mind) and reoptimize your survey for your audience and for your goals.

Ready to put your knowledge of survey design to use? Start gathering feedback with Delighted’s free customer experience solution or customize our survey templates to gather impactful insights within minutes.

Survey design best practices

If you’re looking for more best practices in survey design, read the following list of resources and question guides to take your surveys to the next level.