Every business wants loyal and satisfied customers. The reality? Every business loses once-loyal and no-longer-satisfied customers for one reason or another.

Customer churn is an inevitable part of running a company – but by measuring it, understanding it, and taking action to improve it, you can turn lost customers into opportunities. And by collecting customer experience data, you can also learn to anticipate when customers are thinking of leaving and work to proactively repair the relationship.

What is customer churn?

Customer churn, also called customer attrition, occurs when a consumer chooses to stop utilizing your product or service. Ultimately, for one reason or another, they’ve decided that they no longer want to be your customer.

What is customer churn rate?

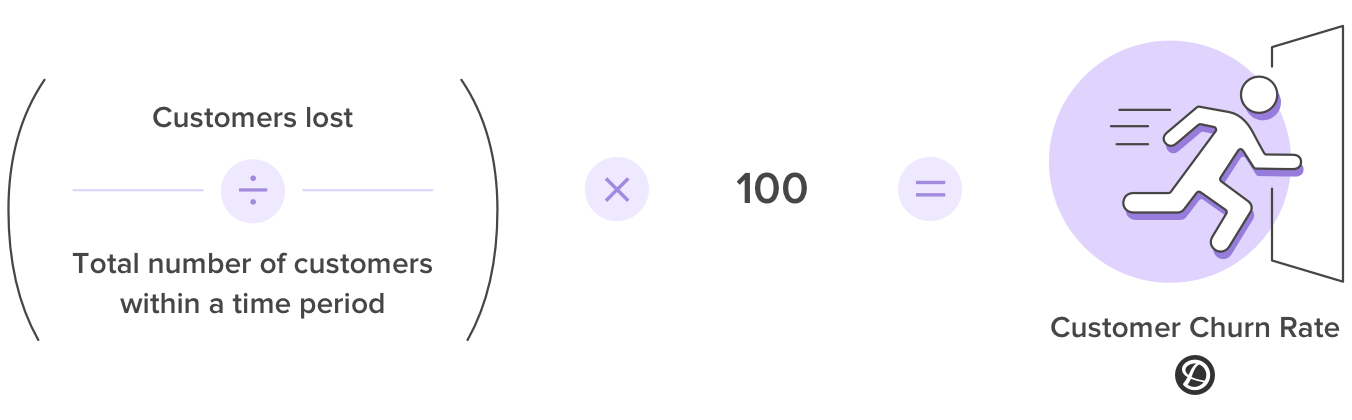

Customer churn rate is the primary metric used for measuring customer churn and is expressed as a percentage. It is highly dependent on the time period in question and measured with this churn calculation formula: (Customers lost ÷ total number of customers within a time period) x 100 = customer churn rate

You can use this calculation to measure your churn rate on a monthly or quarterly basis, to better understand how your business’s initiatives are impacting customer attrition.

For example, the churn calculation for your January churn rate would be:

((Customer count at beginning of January – customer count at the end of January) ÷ customer count at beginning of January) x 100 = customer churn rate for January

If Company A had 400 customers at the beginning of January and 380 customers at the end of January, the churn rate would be:

((400 – 380)/400) x 100 = 5%

Keep in mind that when conducting a customer churn analysis, you want to be clear on your definition of when a customer has churned. Some products are created for a one-time purchase, while others are subscription-based.

If your customers haven’t purchased from you in a while, it might not be that they’ve churned, per se, it could just be that they don’t need to make frequent purchases from you.

What causes customer churn?

There are myriad reasons why you might be losing customers, and many will be unique to your company and the way you run your business.

Here are a few to consider.

1. You’re hyper-focused on new customers

Customer service teams can often beat churn behavior before it happens. And yet, a lot of the time, companies will hyperfocus their resources on new customers only, and forget to nurture existing customer relationships.

The fix? Ensure your customer-focused teams provide white-glove service to all customers, new and existing, to avoid a suffering customer retention rate.

2. You’re not taking the time to understand your customer journey

Understanding your customers’ needs and key stages in their journey with your company is essential to retaining customers long term and reducing churn.

If you haven’t done so already, create a customer journey map so you can understand your customers’ intentions, motivations, pain points – and why they choose your company among competitors.

3. Your competition offers higher quality solutions

If your lost customers go to a direct competitor, this might mean you didn’t offer a unique value-add. When this happens, take the time to evaluate (or re-evaluate) the features or services you’re offering to your target customers. It might be time to make some changes to your business model.

TIP: Take another look at your buyer personas to revisit questions like, “What is my potential customer looking for?” and “What would make this customer choose us over our competitors?”.

4. Your customers no longer see your product as a value-add

As your customer uses your product or service over time, it’s normal for them to relook at their budget and consider, “Do we really need this?”.

That’s why it’s critical to remind your customers on Quarterly Business Reviews or customer calls of the benefit that your product has on their lives; whether that’s finding ease through automation or filling in a gap that would be wide open if they churn. Remind customers why they should be excited, again, about their investment in your business.

Why is measuring customer churn important?

Customer churn happens at every company. But if your churn rate is sustained or trending up over time, it’s mission-critical to understand why – and reduce it.

Here are a couple of reasons why.

1. Customer churn costs you money

Large numbers of churning customers can affect more than your bottom line. Figuring out how to acquire new customers will also require time – and money. That’s why it’s crucial to focus on building great experiences for your existing customers.

The more happy customers you have, the less time and money you have to spend trying to find new ones.

2. Unhappy customers can detract from your brand

A churned customer may not necessarily be an unhappy customer, but you don’t want to take that chance. Nowadays, an unhappy customer can take to social media and make a big splash with a negative review.

Viral tweet or not, you always want to reach out to customers in danger of churning to try and restore the relationship.

How to reduce customer churn

Measuring your churn rate over time will expose a lot about the relationship you have with your customers: Is it them, not you? Is it you, not them?

Here are a few ways to get started understanding your company’s churn rate progression to improve overall customer satisfaction and reduce churn.

1. Understand why your customers churn

In order to prevent churn, you need to understand your own customer experience.

For example, when our customers cancel their Delighted accounts in-app, we reach out to them to learn more about why they’ve left. We then segment the feedback by user-type and customer lifetime value and then pair utilization metrics to help locate the signs that led them to churn.

2. Recognize the tell-tale signs of churn

Next, you want to track your customers’ activity level and utilization, and identify where in the customer journey they churn. A good indicator of customer churn is a wavering Net Promoter Score (NPS).

Not measuring NPS at your organization? Delighted’s NPS tool enables you to collect, analyze, and act on customer feedback in order to improve customer loyalty.

TIP: Set up our weekly digests to stay up-to-date on how your overall NPS program is doing, or set up Alerts to route all negative feedback to your inbox.

3. Measure customer satisfaction

Customer Satisfaction Score (CSAT) surveys help you hear from more of your customers and gain deeper insights from their feedback, giving you the power to craft better experiences for them and work to reduce churn.

Delighted’s customer satisfaction software also allows you to visualize and segment feedback for at-a-glance reporting and analysis.

4. Take action on customer feedback

Regardless of whether you decide to ask for customer feedback with NPS surveys, CSAT surveys, or another type of customer survey, the most critical step to take after you’ve gathered feedback is to act on it.

Acting on feedback shows customers that you value their loyalty – a feeling you want them to have as you work to reduce churn. Plus, when you act on feedback, you’ll gain better insight into what works to keep customers happy, another helpful tool for predicting churn before it happens.

Get ahead of churn by gathering and acting on feedback from your customer base with Delighted’s self-serve experience management software.